Wallet Orchestration for DeFi Project

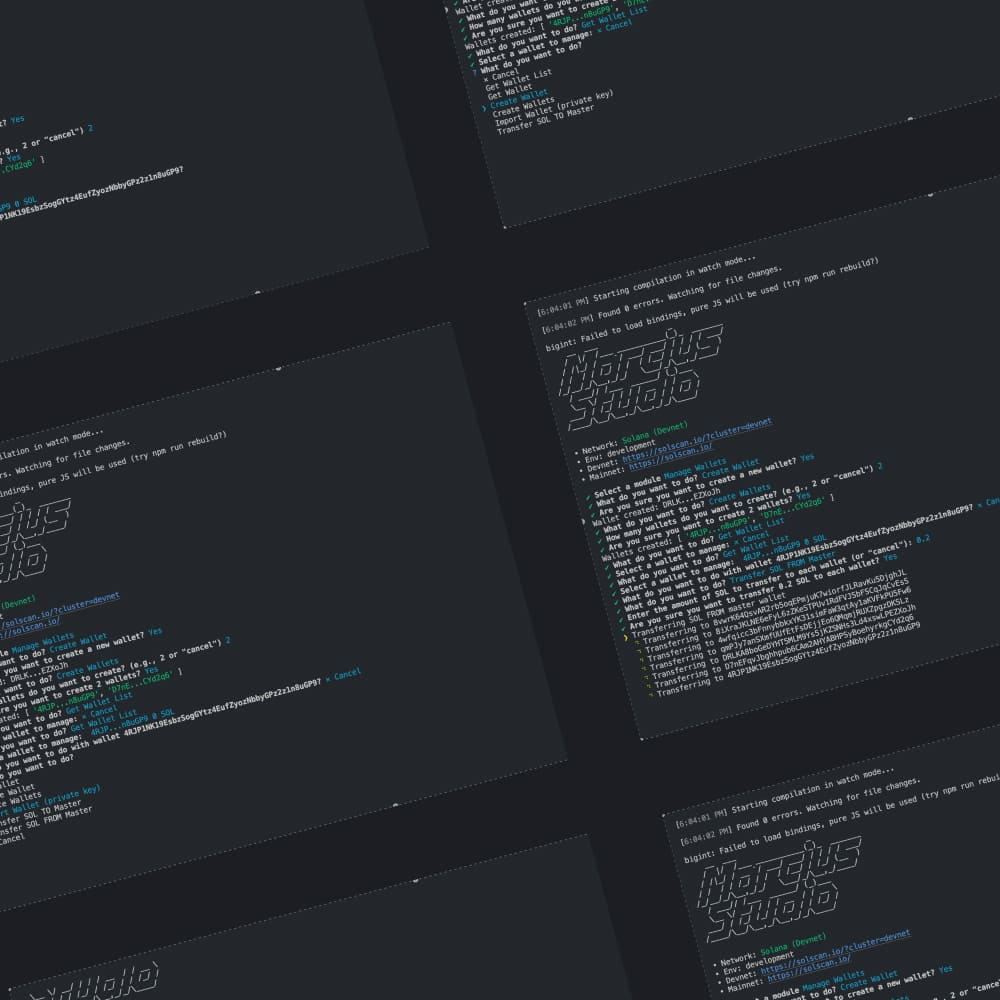

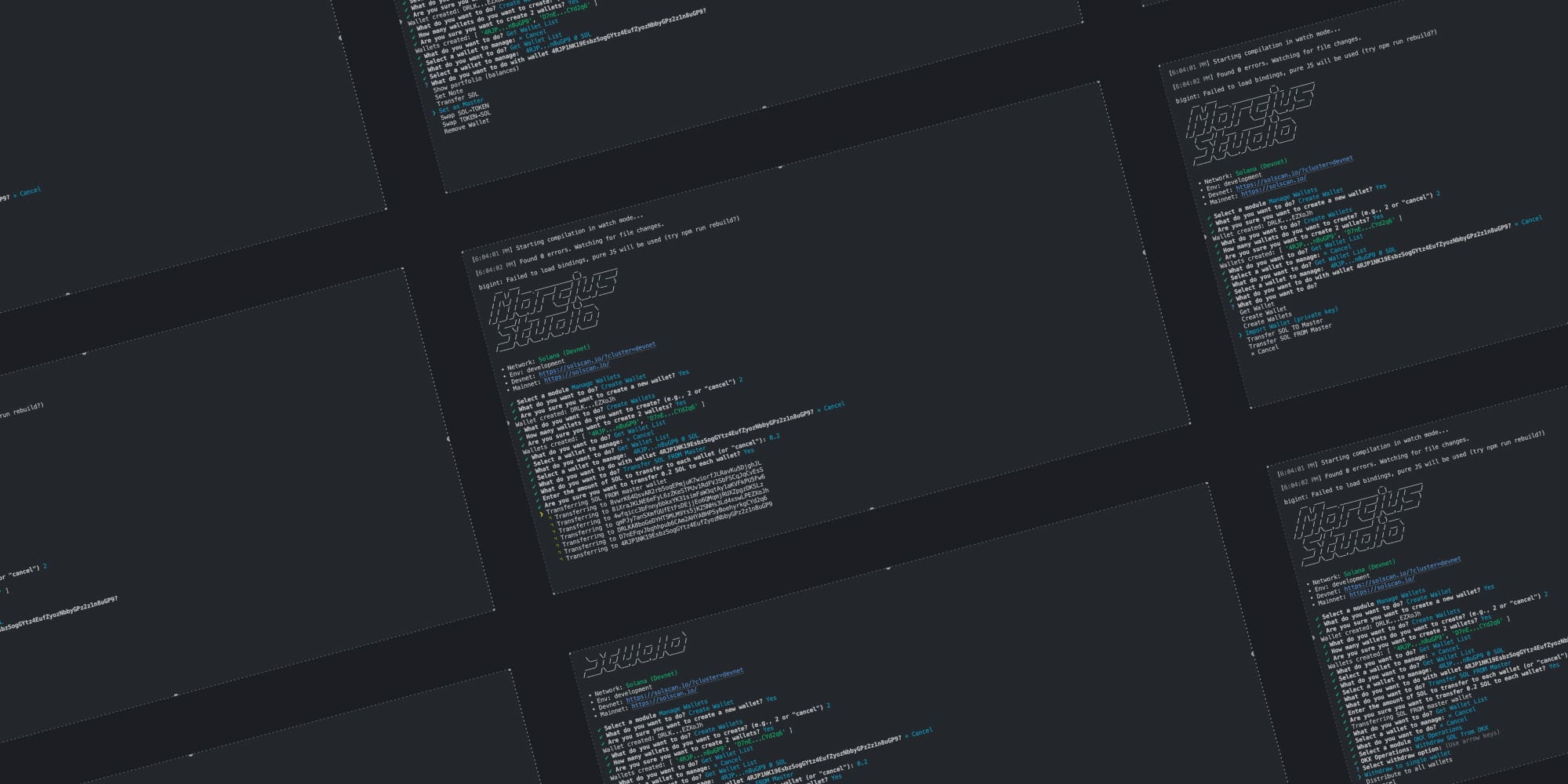

Wallet Orchestration DeFi: Console App

- Problem: A DeFi startup needed to manually manage hundreds of operations for testing strategies and liquidity. This process was slow, expensive, and risky due to human errors.

- Solution: We developed a tool to automate compliant operations (exchange withdrawals, asset distribution, DEX deposits).

- Result: Operation time reduced by 85%, errors eliminated, and regulatory compliance (US and international standards) guaranteed.

Disclaimer

Investing involves risk — always do your own research (DYOR) and seek professional advice. We are not responsible for any financial losses.

Read MoreClient Background#

An innovative DeFi startup (Solana ecosystem) developing liquidity management and market analysis tools. Goal: creating transparent and legally compliant solutions for professionals.

The Challenge#

- Low efficiency: Manual operations were time-consuming and often led to errors (incorrect amounts, addresses).

- Regulatory risks: Required solution needed to:

- Automate routine tasks

- Eliminate market manipulation

- Ensure audit transparency

- Enable investor demonstrations

Our Solution#

Wallet Orchestration DeFi: Console App

We developed a wallet orchestrator focused on utility and full legal compliance.

Key Software Operations (Compliant)

- Fund withdrawals: Scheduled withdrawal of SOL/tokens from centralized exchanges (CEX) to subsidiary wallets.

- Asset distribution: Movement of funds between wallets (>100) according to specified rules (uniform, random) to emulate organic flow.

- DEX deposits: Automatic liquidity provision on decentralized exchanges (Raydium, Orca) without price-influencing coordination.

- Randomization: Random amounts and delays between operations to simulate natural behavior.

- Security: Strict key management, detailed logging, blockchain explorer integration.

- Administrative trading operations: Execution of individual trading operations for selected wallets via orchestrator interface. Important: No automation, synchronization or mass execution.

Legal Safety - Foundation of the Solution

- Strict limitations: Prohibited any market manipulation-like activities (artificial price/volume influence, hidden control).

- Regulatory compliance: Project verified against key US (exchange law) and international AML standards (traceability, audit).

- Clear purpose: Tool created EXCLUSIVELY for operational efficiency and testing, not for speculation.

Important

The solution is safe and legal because its functionality is strictly limited to useful tasks and complies with regulatory standards.

Technologies#

Node.js, NestJS, Prisma/PostgreSQL, solana/web3.js, Solana RPC nodes.

The Results#

- Operation speed increased by 85%

- Legal risks minimized through transparency and auditability

- Strategy and infrastructure testing quality significantly improved

Takeaways#

Wallet orchestration is a powerful DeFi tool. Our case proves: it's possible to create highly efficient and completely legal solutions while strictly adhering to regulatory norms.

Ensure security and compliance for your DeFi product. Order smart contract audit & development with us.

Audit My Project